SGA’s Graphite for Nuclear Energy Production

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 4,164,251 SGA shares and 1,466,250 SGA options, the Company’s staff own 18,000 SGA shares and 7,500 options at the time of publishing this article. The Company has been engaged by SGA to share our commentary on the progress of our Investment in SGA over time.

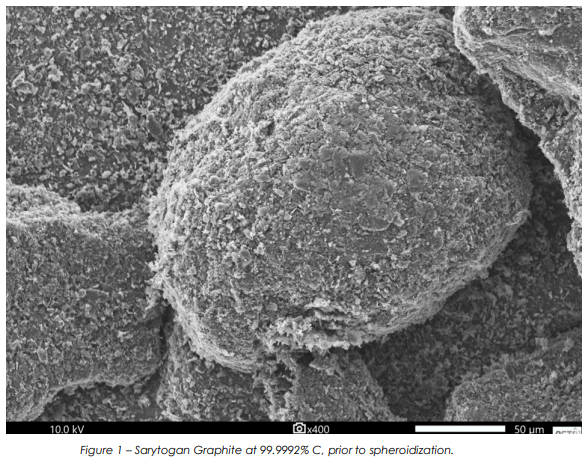

Nuclear grade.

99.9992% purity graphite.

Five Nines and now able to produce high purity graphite needed in nuclear reactors.

Our 2022 Small Cap pick of the Year, Sarytogan Graphite (ASX:SGA) has now successfully produced “nuclear grade” graphite.

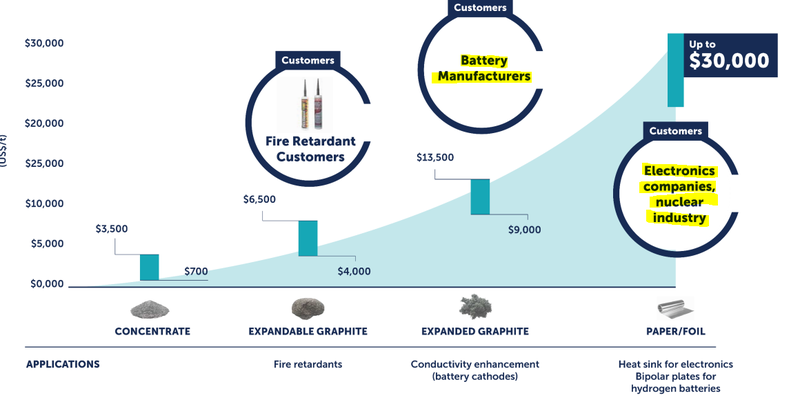

...and sells at ultra premium pricing of more than US$25,000 per tonne.

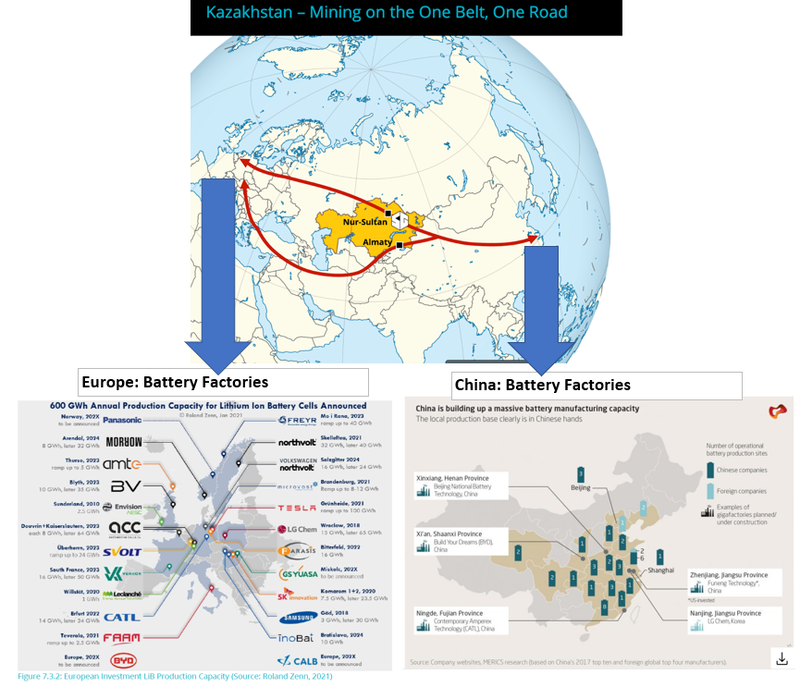

SGA holds 100% of a huge graphite project in Kazakhstan, strategically located between Europe and China.

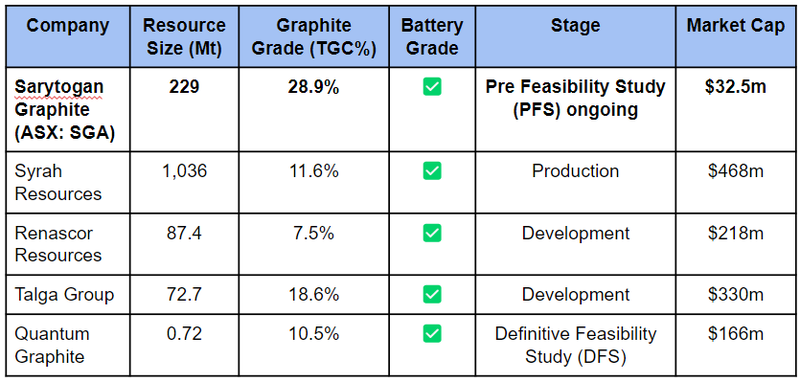

SGA has the highest grade graphite resource of any ASX listed graphite company. It is also the second largest contained graphite resource on the ASX.

Everybody knows how important high purity graphite is for EV batteries...

Graphite makes up ~50% of the raw materials in every lithium-ion battery and over 95% of every battery anode.

SGA has a GIANT graphite deposit, but the market wanted to know if SGA’s graphite can be purified and sold for premium prices...

3 months ago SGA’s test work has CONFIRMED that their graphite can be purified to above 99.95% needed for EV battery grade...

Last month SGA confirmed that their battery grade graphite performed better than synthetic graphite in battery tests...

And SGA has now announced even higher purity of 99.9992% can be achieved for use in nuclear reactors.

The next major catalyst for SGA is plugging all these premium pricing numbers into their pre feasibility study (PFS).

SGA has said the PFS should be out in Q3 and here is where the market will find out the economics of SGA’s proposed mining operation.

Including CAPEX, OPEX and life of mine revenue.

A key document at this stage of a resource company's lifecycle.

Adding ultra premium priced US $25,000/tonne nuclear grade graphite will hopefully materially increase the mine’s revenue and margins.

We think the market is less aware of the nuclear energy uses of high purity graphite.

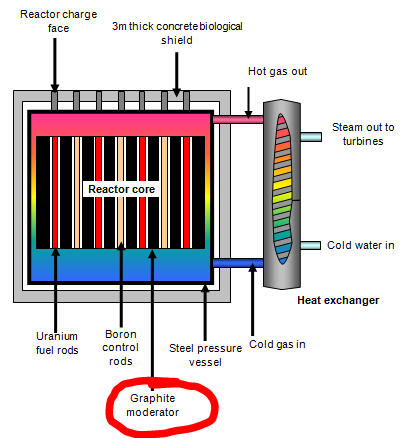

Graphite is a critical material in nuclear reactors.

One of the most important use cases is to surround uranium fuel rods to control the release of energy from the reactor.

To be suitable for nuclear reactors, the graphite needs to have very high purity (≥99.999%) AND low impurities.

On Wednesday SGA produced 2.2kg of graphite concentrate that meets those requirements...

- SGA produced graphite with five nines purity levels - purity up to 99.9992%, which is more than 50x purer than levels needed for use in batteries.

- Low impurities - low impurities (0.032ppm of boron whereas the max limit for nuclear is 2ppm.

The significance of the news?

SGA now adds a very high value add market that it could potentially sell its graphite into - a market where prices fetch significant premiums to even the battery market.

And the ability to sell into multiple markets will be important when it comes time for SGA to put out its Pre Feasibility Study (PFS) in Q3 later this year.

(Source from EV1 investor deck)

SGA is currently working on the PFS which will give us a first look at the project economics and potential returns from its project.

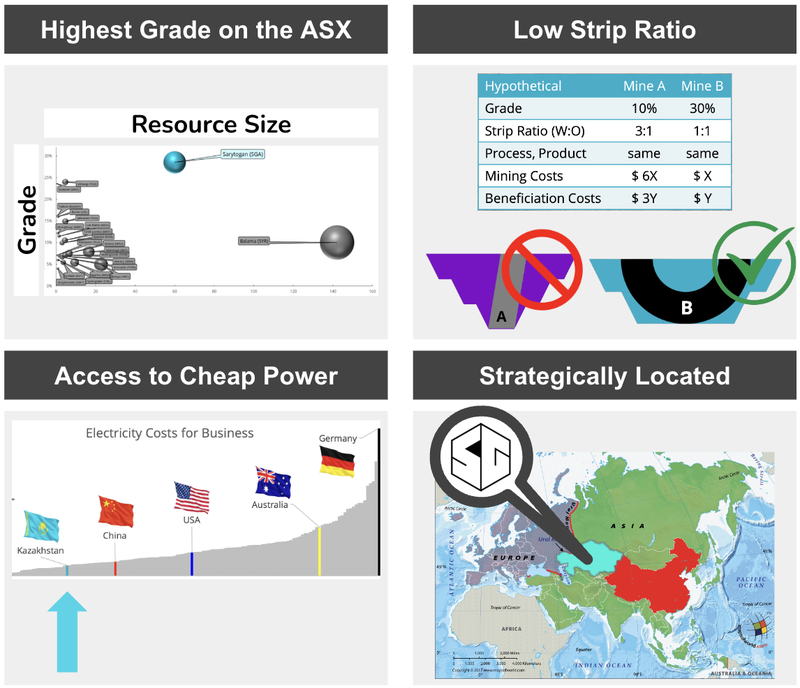

We already know that SGA’s graphite project in Kazakhstan is:

- The highest grade resource on the ASX - In mining grade is king. Higher grades typically lead to lower costs of processing a resource into a final saleable product.

- The second largest graphite resource on the ASX in terms of contained graphite - Second only to Syrah Resources, which is capped at $469M.

Despite this, and all of the progress SGA has made on the network front (showing its graphite is suitable for batteries and then now in the nuclear industry) - SGA trades at a fraction of the market cap relative to its peers.

SGA is currently capped at ~$32M, whereas most of its peers trade at >$160M.

Our view is that the PFS will start to put some financial context around the project SGA has on its hand and will be a catalyst to help bridge the valuation gap between SGA and its peers.

We continue to hold a large position in SGA and are holding on as the company makes progress in what has been one of the worst graphite markets we have seen in markets.

It almost reminds us of the 2018-2020 lithium bear market where things got pretty grim...

However just like it happened then, the companies that continued plugging away during the downturn progressing their assets, were rewarded once the cycle turned.

Everyone knows the Pilbara Minerals story going from ~15c to almost $6 and the success we had Investing in Vulcan Energy Resources back in 2019.

Vulcan went from 26 cents to a high of ~$16 during the raging lithium bull market.

We are hoping that the same could happen in the graphite sector.

(there wasa run in sentiment on graphite last year when China banned graphite exports)

We touched on how companies that plug away during down markets can be rewarded in up markets in a previous weekend note here: Surfing the commodities cycles

Why we think the PFS could be a game changer for SGA:

The PFS will be all about showing to the market how SGA’s project stacks up financially.

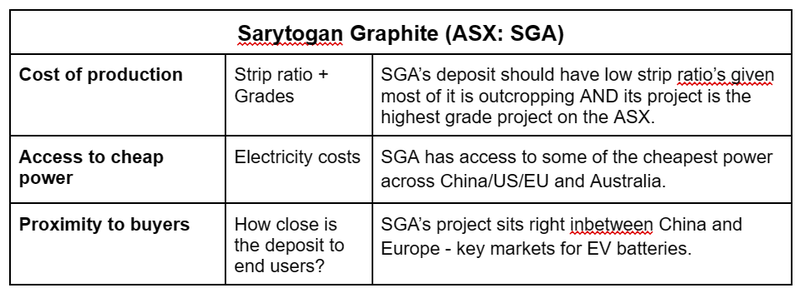

And when it comes to project economics there are usually three major factors that come together to produce strong NPV’s.

The more boxes a project ticks, the more likely the NPV number is going to be strong.

Those factors are:

- The cost to produce the commodity - usually a company needs to have high grades and a low strip ratio to be able to produce the commodity at a low cost.

- Access to cheap power - power is a big part of the variable cost of running a mine so low power costs should mean low operating costs.

- Proximity to markets (target buyers) - the closer the project to buyers the lower the cost should be to ship the product to customers.

SGA’s deposit has all three of those:

Putting this all together, we think SGA has the perfect mix of the key inputs that should form the basis for a strong PFS and we are looking forward to that in Q3 of this year.

The latest from MD Sean Gregory -

We saw Sean present at the RIU ExplorersConference in Perth a few weeks back.

Check out Sean’s 10 minute presentation here:

(Source)

What we want to see from SGA next

Pre-Feasibility Study 🔄

As mentioned above, we think the PFS could be a big catalyst for SGA.

IF the Net Present Value (NPV) numbers are big, then the market may start to factor that into SGA’s market cap.

This catalyst is expected in Q3 2024.

SGA has mentioned in its recent quarterly that the PFS would model a ~50,000tpa operation.

Clearly, SGA is looking to plug into its models the perfect sized mine that maximises the NPV number for as little CAPEX as possible, instead of going for size without any consideration for marginal returns.

The upside is that SGA could always look to upgrade its project if demand became overwhelmingly strong.

More Battery Testing Results 🔄

SGA is currently running long term tests for its Uncoated Spherical Graphite in batteries - we expect to see updates on longer term testing results over the coming months.

In addition, SGA mentioned that it would run further tests with Coated Spherical Graphite, which should improve performance.

Offtake Agreements?

SGA has now shown it can produce graphite suitable for EV batteries and for the nuclear industry.

It has also mentioned recently that its looking to appoint a marketing manager to go out there and engage with buyers.

Its relatively early days on the offtake front but any announcement could be a positive surprise to the market.

Complimentary Projects?

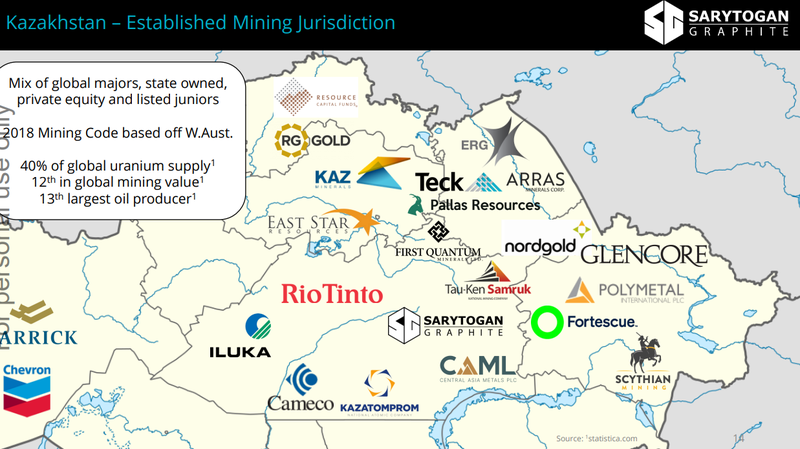

SGA has an established team in Kazakhstan, a jurisdiction that is very mining friendly.

Companies like Glencore, Fortescue, Rio Tinto and Chevron have assets in country...

With a current downturn in sentiment for battery metals, SGA may be in a position to pick up an additional asset on the cheap in the country.

Aiding SGA are jurisdictional benefits in Kazakhstan.

For instance, we recently attended a special Kazakhstan mining industry session at a major Canadian mining conference called PDAC.

There, we learned that Kazakhstan is funding what is called “pre-competitive” geophysics – nationwide.

The hope is to attract a host of eager exploration companies that can draw upon pre-existing, government funded exploration work.

The perfect kickstart..

More resources, means more investment and a more stable jurisdiction.

However, in the short term the market will be looking for the company to deliver catalysts like the ones we mentioned above.

We are long term SGA holders and are Invested in the company to see it take its graphite project through the feasibility studies and hopefully attract interest from majors looking to takeover a graphite asset.

That forms the basis for our Big Bet which is as follows:

Our SGA “Big Bet”

“Given this graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SGA Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

What are the risks?

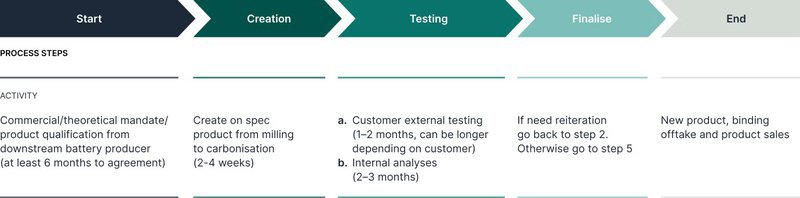

In the short term the key risks to our SGA Investment Thesis is “product qualification risk”.

SGA has managed to produce battery grade graphite and graphite suitable for the nuclear industry BUT it now needs to have the product qualified by prospective buyers.

That is where SGA takes its graphite products to buyers who run their own tests to see if what SGA says is true.

This process can take a while to complete (up to 2 years in extreme scenarios) AND there is never a guarantee that SGA gets past the qualification stage.

Another risk is “funding risk”.

SGA had $4.8M cash in the bank at 31 December 2023, which means SGA could look to top up its balanzce sheet in the coming months.

Like most micro cap companies SGA is pre-revenue and will need to raise capital to pay for all the work the company is doing.

To see more risks that we listed as part of our SGA Investment Memo click here.

Our SGA Investment Memo

Below is our Investment Memo for SGA, where you can find a short, high level summary of our reasons for Investing.

In our SGA Investment Memo, you’ll find:

- Our SGA Big Bet

- Key objectives went want to see SGA achieve

- Why we are Invested in SGA

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.